Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

INFORMATION REQUIREDIN

PROXY STATEMENT Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | | |

Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý☒ |

|

Definitive Proxy Statement |

o☐ |

|

Definitive Additional Materials |

o☐ |

|

Soliciting Material under §240.14a-12Pursuant to§240.14a-12 |

Emergent BioSolutions Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | |

Emergent BioSolutions Inc. | |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý☒ |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ☐ | | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| ☐ | | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules14a-6(i)(1) and0-11. |

INSERT TITLE PAGE

PLACEHOLDER

Table of Contents

April 9, 2020

Dear Fellow Stockholders:Shareholders,

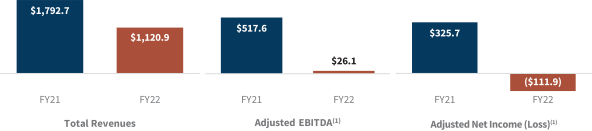

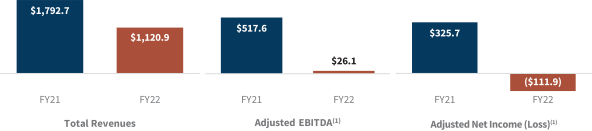

You are cordially invited to attendAs the world emerges from the darkest days of the COVID-19 pandemic, much has changed in the business environment in which Emergent BioSolutions Inc. 2020 annual meeting of stockholders to be held on May 21, 2020, at 9:00 a.m., Eastern time. Duenow operates. The pandemic opened many eyes to the emergingimportance of public health impact ofpreparedness which brings both added opportunities and scrutiny.

Our results in 2022 reaffirm our longstanding partnership with government and public health customers and provide a good foundation from which we expect to grow. Not only are we continuing to supply vaccines to the coronavirus outbreak (COVID-19) andStrategic National Stockpile, but we are fulfilling orders for new products to support the health and well-being ofexpand our partners and stockholders, this year's annual meeting will be a completely virtual meeting of stockholders, conducted via live audio webcast. Details about the meeting, nominees for thenation’s medical countermeasures. The Board of Directors is confident in Emergent’s ability to stabilize operations, improve profitability and other mattersrealize sustainable growth more in line with pre-pandemic trends.

Even with these changes, our collective commitment to be acted on are includedprotect and enhance life has never wavered. I believe this mission is more critical than ever as we work with U.S. and international governments to prepare for the myriad public health threats we face.

I remain optimistic about Emergent’s future in the Notice of Internet Availability of Proxy Materialsnear, medium, and proxy statement that follow. To be admitted to the annual meeting atwww.virtualshareholdermeeting.com/EBS2020, you must enter the 16-digit control number which appears on your proxy card, voting instruction form or notice you will receive.

We hope you plan to attend the annual meeting. You may vote during the virtual annual meeting by following the instructions available on the meeting website. Whether or not you plan to attend the annual meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in our proxy statement or the Notice of Internet Availability of Proxy Materials. Your proxy may be revoked at any time before it is exercised as explained in our proxy statement.

On behalf of thelong term. The Board of Directors will work tirelessly to ensure we are executing our strategy with the necessary oversight and management, it is my pleasure to express our appreciationgovernance that position Emergent and its stakeholders for your support.success.

|

| Sincerely, |

|

| | Sincerely, |

|

|

|

| Zsolt Harsanyi, Ph.D. |

| Fuad El-Hibri

Executive Chairman of the Board of Directors |

| April 14, 2023 |

|

|

| YOUR VOTE IS IMPORTANT |

|

| PLEASE TAKE TIME TO VOTE AS PROMPTLY AS POSSIBLE |

|

| NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS |

YOUR VOTE IS IMPORTANT.

PLEASE TAKE TIME TO VOTE AS PROMPTLY AS POSSIBLE.

Table of Contents

EMERGENT BIOSOLUTIONS INC.

400 PROFESSIONAL DRIVE, SUITE 400

GAITHERSBURG, MARYLAND 20879

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 21, 2020

To Our Stockholders:

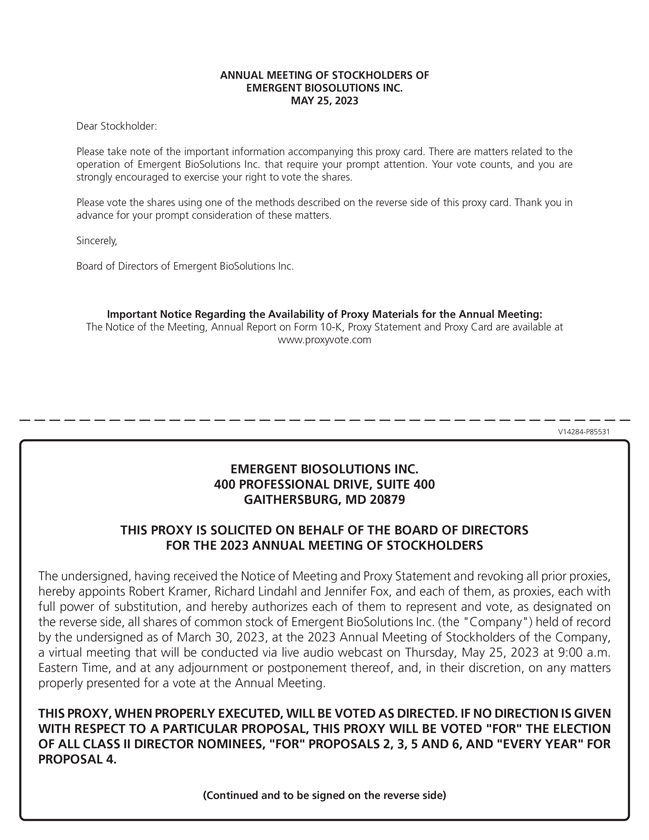

The 2020 Annual Meeting2023 annual meeting of Stockholdersstockholders of Emergent BioSolutions Inc. will be held on May 21, 2020,25, 2023, at 9:00 a.m., Eastern Time. The safety of our stockholders is important to us, and given the current guidance by public health officials surrounding the coronavirus outbreak (COVID-19) and group gatherings, this year's annual meeting will be a "virtual meeting" of stockholders. You will be able to attend the annual meeting, vote, and submit questions via live webcast by visitingwww.virtualshareholdermeeting.com/EBS2020EBS2023.

The annual meeting will be held for the following purposes:

1.| 1. | To elect three Class II directors to hold office for a term expiring at our 2026 annual meeting of stockholders, each to serve until their respective successors are duly elected and qualified; |

| 2. | To ratify the appointment by the audit and finance committee of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2023; |

| 3. | To hold, on an advisory basis, a vote to approve the 2022 compensation of our named executive officers (“NEOs”); |

| 4. | To hold, on an advisory basis, a vote on the frequency of future stockholder advisory votes on the compensation of our NEOs; |

| 5. | To approve an amendment of our stock incentive plan; and |

| 6. | To approve an amendment of our employee stock purchase plan. |

We are mailing this notice beginning on or about April 14, 2023 with instructions on how to hold office for a term expiring ataccess our 2023 annual meeting of stockholders, each to serve until their respective successors are duly electedproxy materials and qualified;

2.To ratify the appointment by the audit committee of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2020;

3.To hold, on an advisory basis, a vote to approve executive compensation; and

4.To act upon any other matter that may properly come before the meeting or any adjournment or postponement of the meeting.

online.As of the date of this notice, the company has received no notice of any matters, other than those set forth above, that may properly be presented at the 20202023 annual meeting. If any other matters are properly presented for consideration at the meeting, the persons named as proxies on the enclosed proxy card, or their duly constituted substitutes, will be deemed authorized to vote the shares represented by proxy or otherwise act on those matters in accordance with their judgment.

The Board of Directors recommends that you vote FOR the election of each of the Class II director nominees, and FOR“FOR” Proposals 2, 3, 5 and 3.6 and “every year” for Proposal 4. The close of business on March 26, 2020,30, 2023 has been established as the record date for determining those stockholders entitled to receive notice of and to vote at the 20202023 annual meeting or any adjournment or postponement thereof.

Your vote is very important.Please read the proxy statement and then, whether or not you expect to attend the annual meeting, and no matter how many shares you own, vote your shares as promptly as possible. You can vote by proxy over the internet, by telephone or by mail by following the instructions provided in the proxy statement and on the proxy card. Submitting your proxy now will help ensure a quorum and avoid additional proxy solicitation costs. To be admitted to the annual meeting atwww.virtualshareholdermeeting.com/EBS2020EBS2023, you must enter the 16-digit control number which appears on your proxy card, voting instruction form or notice you will receive. You may vote during the annual meeting by following the instructions available on the meeting website during the meeting. You may vote virtually at the annual meeting, even if you have previously submitted a proxy. If you hold shares through a broker, bank or other nominee and wish to vote your shares at the annual meeting, you will need your unique control number that accompanies the instructions that the broker, bank or other nominee provides to you with the proxy materials.If you have any questions about voting your shares or attending the virtual annual meeting, please contact our Investor Relations department at (240) 631-3200.

631-3200 or by email at investorrelations@ebsi.com.

Table of Contents

You may revoke your proxy before the vote is taken by delivering to our Corporate Secretary a written revocation, submitting a proxy with a later date or by voting your shares virtually at the meeting, in which case your prior proxy will be disregarded.

| | |

| | By Order of the Board of Directors, |

|

|

|

|

|

Atul Saran

Jennifer L. Fox |

Executive Vice President, Corporate Development,

External Affairs, General Counsel and Corporate Secretary |

Gaithersburg, Maryland

MD

April 9, 202014, 2023

|

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 25, 2023 |

Table of Contents

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

2020 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 21, 2020

The company'scompany’s proxy statement for the 20202023 annual meeting of stockholders and annual reportAnnual Report on Form 10-K for the fiscal year ended December 31, 2019,2022, are available athttp://materials.proxyvote.com/29089Qwww.proxyvote.com.

|

|

| WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOUR VOTE IS IMPORTANT. IN ORDER TO ENSURE THE REPRESENTATION OF YOUR SHARES AT THE 2023 ANNUAL MEETING, PLEASE VOTE BY PROXY AS PROMPTLY AS POSSIBLE. |

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOUR VOTE IS IMPORTANT.

IN ORDER TO ENSURE THE REPRESENTATION OF YOUR SHARES AT THE 2020 ANNUAL

MEETING, PLEASE VOTE BY PROXY AS PROMPTLY AS POSSIBLE.

Table of Contents

TABLE OF CONTENTS

|

| EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy 1 |

Table of Contents

EMERGENT BIOSOLUTIONS INC.

400 Professional Drive, Suite 400

Gaithersburg, Maryland 20879

PROXY STATEMENT

2020 Annual Meeting of Stockholders

This proxy statement and the accompanying proxy card are being furnished to you by the Board of Directors of Emergent BioSolutions Inc. (the "Board"“Board” or "Board“Board of Directors"Directors”) to solicit your proxy to vote your shares at our 20202023 annual meeting of stockholders and at any adjournment or postponement of the meeting. The annual meeting will be conducted in virtual format via live audio webcast on May 21, 2020,25, 2023, at 9:00 a.m. Eastern Time. Stockholders can attend the meeting via the internet atwww.virtualshareholdermeeting.com/EBS2020.EBS2023.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why am I receiving this proxy statement?

You are receiving this proxy statement from us because you owned shares of the company'scompany’s common stock as of March 26, 2020,30, 2023, the record date for the annual meeting. The Board has made these materials available to you in connection with the Board'sBoard’s solicitation of proxies for usevotes at our annual meeting.

This proxy statement describes matters on which you may vote and provides you with other important information so that you can make informed decisions. You are requested to vote on each of the proposals described in this proxy statement and are invited to attend the annual meeting.

What does it mean to vote by proxy?

It means that you give someone else the right to vote your shares in accordance with your instructions. In this way, you ensure that your vote will be counted even if you are unable to attend the annual meeting. When you submit your proxy by internet, by telephone or by mail, you appoint each of Robert G. Kramer, our president and chief executive officer, Richard S. Lindahl, our executive vice president, chief financial officer and treasurer, and Atul Saran, our executive vice president, corporate development, general counsel and corporate secretary, or their respective substitutes or nominees, as your representatives — your "proxies" — at the meeting to vote your shares in accordance with your instructions. If you give your proxy but do not include specific instructions on how to vote, the individuals named as proxies will vote your shares as the Board recommends, and may vote in their discretion with respect to any other matters properly presented at the annual meeting.

Who is entitled to vote at the annual meeting?

Holders of the company'scompany’s common stock as of the close of business on the record date, March 26, 2020,30, 2023, may vote by proxy or virtually at the annual meeting. As of the close of business on March 26, 2020,30, 2023, there were 52,266,43350,398,410 shares of the company's common stock outstanding and entitled to vote and held by 25vote. As of that date, we had 18 holders of record. The common stock is the only authorized voting security of the company, and each share of common stock is entitled to one vote on each matter properly brought before the annual meeting.

|

| EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy 1 |

| | | | | | |

| |  | |  | |  |

| Meeting Date: | | Meeting Place: | | Meeting Time: | | Record Date: |

| | | |

| May 25, 2023 | | Virtual | | 9:00 am Eastern Time | | March 30, 2023 |

| | | |

| | (www.virtualshareholdermeeting.com/EBS2023) | | | | |

Voting matters, to be voted onvote standard and what is the Board's recommendation and the applicable voting standard?

Board vote recommendations

| | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|---|

| | | | | | | | | | | | | | | | | | | | | | |

| Proposal | | Proposal | | | | Voting Choices and Board

Recommendation

|

| | | Voting Standard

|

| | | Effect of

Abstentions

|

| | | Effect of

Broker

Non-Votes

|

| |

| | | | | | | | | | | | | | | | | | | | | | |

| | 1. | | Election of Directors | | | | •Effect of

Abstentions/

Withheld Votes | | Effect of Broker Non-Votes |

| 1. | | Election of Class II Directors | | ○Vote in favor of alleach of Sujata Dayal, Zsolt Harsanyi, Ph.D., and Louis W. Sullivan, M.D.; or specific nominees; •

Vote against all or specific nominees; or

•

Abstain from voting○ Withhold vote with respect to all or specific nominees.

The Board recommends a vote FOR each of the director nominees. | | | | Plurality of votes cast

(the nominees who receive the most votes will be the nominees elected by stockholders) | | None | | None |

| 2. | | | | None | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 2. | | Ratification of the appointment of Ernst & Young LLP as the company'scompany’s Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2020 | | 2023 | | •

○Vote in favor of the ratification; •

○Vote against the ratification; or •

○Abstain from voting on the ratification. The Board recommends a vote FOR the ratification of Ernst & Young LLP as our Independent Registered Public Accounting Firm. | | | | Majority of votes cast | | None | | NoneNot applicable (broker will have discretionary authority to vote your shares if you do not provide instructions) |

| 3. | | | | Not applicable | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 3. | | Advisory vote to approve executivethe 2022 compensation | | of NEOs | | •

○Vote in favor of the proposal; •

○Vote against the proposal; or •

○Abstain from voting on the proposal. The Board recommends a vote FOR the advisory vote to approve executive compensation.the 2022 compensation of our NEOs. | | | | Majority of votes cast | | None | | None |

| 4. | | Advisory vote on the frequency of future stockholder advisory votes on the compensation of NEOs | | None○ Vote “every year”; ○ Vote “every two years”; ○ Vote “every three years”; or ○ Abstain from voting on the proposal. The Board recommends a vote of “every year” for the frequency of future stockholder advisory votes on the compensation of NEOs. | | Option receiving the highest number of votes | | None | | None |

|

| | | | | | | | | | | | | | | | | | | | 2 EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy |

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Proxy Statement

You may own shares of the company's common stock in two different ways:

•Record Ownership. If your stock is represented by one or more stock certificates registered in your name or if you have a Direct Registration System account in your name evidencing shares held in book-entry form, then you have a stockholder account with our transfer agent, Broadridge Financial Solutions, Inc., and you are a "stockholder of record."

•Beneficial Ownership. If your shares are held in a brokerage account or by a bank or other nominee, those shares are held in "street name" and you are considered the "beneficial owner" of the shares. As the beneficial owner of those shares, you have the right | | | | | | | | | | |

| Proposal | | Voting Choices and Board Recommendation | | Voting Standard | | Effect of Abstentions | | Effect of Broker Non-Votes |

| 5. | | Approve amendment to the company’s stock incentive plan | | ○ Vote in favor of the proposal; ○ Vote against the proposal; or ○ Abstain from voting on the proposal. The Board recommends a vote FOR the approval of the amendment to the company’s stock incentive plan. | | Majority of votes cast | | None | | None |

| 6. | | Approve amendment to the company’s employee stock purchase plan | | ○ Vote in favor of the proposal; ○ Vote against the proposal; or ○ Abstain from voting on the proposal. The Board recommends a vote FOR the approval of the amendment to the company’s employee stock purchase plan. | | Majority of votes cast | | None | | None |

How to direct your broker, bank or other nominee how to vote your shares, and you will receive separate instructions from your broker, bank or other nominee describing how to vote your shares.

Table of ContentsVote

How do I vote my shares?

If you are a stockholder of record, you may vote your shares:

| | |

| | By Internet.

|

| Before The Meeting- Go towww.proxyvote.com. Use the internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on May 20, 2020.24, 2023. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

|

| | During The Meeting- Go towww.virtualshareholdermeeting.com/EBS2020EBS2023. You may attend the meeting via the internet and vote during the virtual meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. |

|

|

By Telephone.To vote by phone,telephone, call 1-800-690-6903 (toll-free from the U.S. and Canada). Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on May 20, 2020.24, 2023. Have your proxy card in hand when you call and then follow the instructions. If you vote by telephone, please do not mail in a proxy card. |

|

|

By Mail.If you received your proxy materials by mail, you may vote by completing, signing and returning your proxy card. If you vote by mail, please mark, sign and date your proxy card and return it in the enclosed postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

You will need to follow the instructions when using any of these methods to make sure your shares will be voted at the annual meeting. We encourage you to vote by telephone or over the internet or by mail by completing your proxy card, even if you plan to attend the virtual annual meeting.

If you hold shares in street name through a broker, bank or other nominee, you may instruct your broker, bank or other nominee to vote your shares by following the instructions that the broker, bank or other nominee provides to you with the proxy materials. Most brokers offer the ability for stockholders to submit voting instructions by mail by completing a voting instruction card, by telephone and over the internet. If you hold shares through a broker, bank or other nominee and wish to vote your shares at the annual meeting, you will need your unique control number which appears on the instructions that accompanied the proxy materials. In any case, voting in advance by phone, internet or mail or through your broker, bank or other nominee will not prevent you from voting at the virtual annual meeting.If you have any questions about voting your shares or attending the virtual annual meeting, please contact our Investor Relations department at (240) 631-3200.631-3200 or by email at investorrelations@ebsi.com.

If I hold shares in street name by my broker, will my broker automatically vote my shares for me?

If you hold shares through an account with a bank or broker,Please review the votingsection at the end of the shares by the bank or broker when you do not provide voting instructions is governed by the rules of the New York Stock Exchange (the "NYSE"). These rules allow banks and brokers to vote shares in their discretion on "routine" matters for which their customers do not provide voting instructions. On matters considered "non-routine," banks and brokers may not vote shares without your instruction.

What is a "broker non-vote" and how would it affect the vote?

Shares that banks and brokers are not authorized to vote are referred to as "broker non-votes." The ratification of the company's independent registered public accounting firm is considered a routine matter. Accordingly, banks and brokers may vote shares on this proposal without your instructions, and there will be no broker non-votes with respect to this proposal.

Table of Contents

All other proposals are considered to be non-routine, and banks and brokers therefore cannot vote shares on those proposals without your instructions. Please note thatproxy statement titled “QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING” if you want your vote to be counted on those proposals, including the election of directors, you must instruct your bank or brokerhave additional questions about how to vote your shares. If you do not provide voting instructions, no votes will be cast on your behalf with respect to those proposals.

Broker non-votes will be counted for purposes of establishing a quorum but will not affect the outcome of the vote on any proposal.

What does it mean if I receive more than one proxy card from the company?

It means that you have more than one account for your shares. Please vote by internet or telephone using each of the identification numbers, or complete and mail all proxy cards to ensure that all of your shares are voted.

What is "householding" and how does it affect me?

The Securities and Exchange Commission ("SEC") has adopted rules that permit companies and intermediaries, such as brokers, to satisfy delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single Notice of Internet Availability of Proxy Materials or proxy statement and annual report addressed to those stockholders. This process, commonly referred to as "householding," potentially provides extra convenience for stockholders and cost savings for companies. Because we utilize the "householding" rules for proxy materials, stockholders who share the same address generally will receive only one copy of the Notice of Internet Availability of Proxy Materials or proxy statement and annual report, unless we receive contrary instructions from any stockholder at that address. If you prefer to receive multiple copies of the Notice of Internet Availability of Proxy Materials or proxy statement and annual report at the same address, additional copies will be provided to you promptly upon request. If you are a stockholder of record, you may obtain additional copies upon written or oral request to Emergent BioSolutions Inc., Attn: Investor Relations, 400 Professional Drive, Suite 400, Gaithersburg, Maryland 20879; Telephone: (240) 631-3200. Eligible stockholders of record receiving multiple copies of the Notice of Internet Availability of Proxy Materials or proxy statement and annual report can request householding by contacting us in the same manner.

If you are a beneficial owner and hold your shares in a brokerage or custody account, you can request additional copies of the Notice of Internet Availability of Proxy Materials or proxy statement and annual report or you can request householding by notifying your broker, bank or other nominee.

How do I attend the annual meeting? When and where will the annual meeting be held?

The annual meeting will be held on May 21, 2020. This year, we will be hosting the annual meeting live via the internet. You will not be able to attend the annual meeting in person. Any stockholder can listenor other procedural questions about voting on matters to be presented at the meeting.

|

| EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy 3 |

|

| SUSTAINABILITY AND CORPORATE SOCIAL RESPONSIBILITY |

Sustainability

We aspire to be a company that prioritizes and participate in the annual meeting live via the internet atwww.virtualshareholdermeeting.com/EBS2020. To participate in the virtual annual meeting, you will need the 16-digit control number which appears on your proxy card, voting instruction form or notice you will receive. The annual meeting webcast will begin promptly at 9:00 a.m., Eastern Time. We encourage you to access the annual meeting webcast priorresponds to the start time. Online check-in will begin,challenges of sustainability and stockholders may begin submitting written questions, at 8:45 a.m., Eastern Time, and you should allow ample time for the check-in procedures. If you do not have a control number, you may attend as a guest (non-stockholder), but will not have the option to vote your shares at the virtual meeting.

What if during the check-in time or during the annual meeting I have technical difficulties or trouble accessing the virtual meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or

Table of Contents

meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

Why are we holding the annual meeting virtually?

As part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the annual meeting, and in lightalso addresses various aspects of the novel coronavirus disease (COVID-19), we believeenvironmental, social, and governance (“ESG”) imperatives that hosting a virtual annual meeting is in our best interest and the best interestmany of our stockholders, and enables increased stockholder attendance and participation during a time when many travel restrictions are in place that may limit attendance. Furthermore, we have determined that hosting a virtual annual meeting of stockholders will provide expanded access, improved communication, and cost savings. Hosting a virtual meeting enables increased stockholder attendance and participation since stockholders can participate from any location around the world. We intend that the virtual meeting format will provide stockholders a similar level of transparency to the traditional in-person meeting format and we will take steps to ensure such an experience. Our stockholders will be afforded the same opportunities to participate at the virtual annual meeting as they would at an in-person annual meeting of stockholders. Our virtual annual meeting allows stockholders to submit questions and comments before and during the annual meeting. After the annual meeting, we will be answering stockholder questions that comply with the rules of conduct for the annual meeting; which will be posted on the virtual annual meeting web portal. To the extent time does not allow us to answer all of the appropriately submitted questions, we will answer them in writing on the company's website atwww.emergentbiosolutions.com under the section "Investors," soon after the meeting. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

How can I change my vote or revoke my proxy?

If you hold shares in your own name as a stockholder of record, you may change your vote or revoke your proxy at any time before voting begins by:

•Giving notice of revocation to our Corporate Secretary, at Emergent BioSolutions Inc., 400 Professional Drive, Suite 400, Gaithersburg, Maryland 20879 (by mail or overnight delivery);

•Executing and delivering to our Corporate Secretary, at the address noted above, a proxy card relating to the same shares bearing a later date;

•Voting by the internet or telephone prior to the time the voting facilities close (your latest internet or telephone vote will be counted); or

•Logging onto and voting at the virtual annual meeting,

If you decide to revoke or change your vote other than by voting at the annual meeting, we must receive the notice of revocation or new vote by 11:59 p.m., Eastern Time, on Wednesday May 20, 2020, the date prior to the date of the annual meeting.

If your shares are held in "street name," you must contact your broker, bank or other nominee to revoke or change your vote. The revocation or change must be made by the broker, bank or other nominee before the annual meeting.

What is the "quorum" for the annual meeting and what happens if a quorum is not present?

In order to conduct business at the annual meeting, the holders of at least a majority of the total number of shares of the company's common stock issued and outstanding and entitled to vote as of the March 26, 2020 record date, or 26,133,217 shares, must be present in person or represented by proxy. This requirement is called a "quorum." If you vote by internet or by telephone, or submit a properly executed proxy card, your shares will be included for purposes of determining the existence of a quorum. Proxies

Table of Contents

marked "abstain" and "broker non-votes" also will be counted in determining the presence of a quorum. If the shares present in person or represented by proxy at the annual meeting are not sufficient to constitute a quorum, the annual meeting may be adjourned to a different time and place to permit further solicitations of proxies sufficient to constitute a quorum.

What is an "abstention" and how would it affect the vote?

An "abstention" occurs when a stockholder submits a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions are counted as present for purposes of determining a quorum. As a general matter, an abstention with respect to the election of directors is neither a vote cast "for" a nominee nor a vote cast "against" the nominee and, therefore, will have no effect on the outcome of the vote. Because an abstention is generally not considered to be a vote "cast" for a particular matter, it will have no effect on the ratification of the appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm or the advisory vote on the compensation of our named executive officers.

Does the company offer an opportunity to receive future proxy materials electronically?

Yes. If you vote on the internet, simply follow the prompts for enrolling in electronic proxy delivery service. This will reduce our printing and postage costs, as well as the number of paper documents you will receive.

If you are a stockholder of record, you may enroll in this service at the time you vote your proxy or at any time after the annual meeting and can read additional information about this option and request electronic delivery by going towww.proxyvote.com. If you hold shares in street name, please contact your broker, bank or other nominee to enroll for electronic proxy delivery.

Who will conduct the proxy solicitation and who will bear the cost?

The costs of soliciting proxies will be borne by us. The solicitation is being made primarily through the mail and electronic mail, but our directors, officers andpartners, suppliers, employees, may also engage in the solicitation of proxies in person, by telephone, electronic transmission or by other means. No compensation will be paid by us in connection with the solicitation of proxies, except that we may reimburse brokers, banks, custodians, nomineescustomers and other record holders for their reasonable out-of-pocket expenses in forwarding proxy materials to beneficial owners.

Who will count the votes?

Broadridge Financial Solutions, Inc. will tabulate the votes cast by internet, telephone and mail. Brian Millard, our Senior Vice President, Corporate Controller, will tabulate any votes cast at the annual meeting and will act as inspector of election to certify the results.

Where can I find the voting results of the meeting?

We will publish the voting results in a Form 8-K filed with the SEC within four business days after the annual meeting. You can read or print a copy of that report by going to either the company's website atwww.emergentbiosolutions.com under the section "Investors — SEC Filings" or the SEC's website atwww.sec.gov.

Will a list of stockholders entitled to vote at the annual meeting be available?

A list of stockholders of record as of March 26, 2020, the record date, will be available for inspection by stockholders for any purpose germane to the annual meeting during normal business hours from May 11, 2020 to May 20, 2020, at our corporate headquarters at 400 Professional Drive, Suite 400, Gaithersburg, Maryland 20879. This list will also be available during the virtual annual meeting for examination by any stockholder atwww.virtualshareholdermeeting.com/EBS2020.

Table of Contents

CORPORATE SOCIAL RESPONSIBILITY

Community Involvement

stakeholders consider important. Our mission to protect and enhance life applies not onlyhas motivated us to explore our impact at a broader scale — ESG stewardship, corporate responsibility, and ethics.

Our approach to these issues is the productsfoundation of good governance and servicesstrengthens accountability in all aspects of our business activities and relationships. Our ESG project is led by a cross-functional working group. The nominating and corporate governance committee oversees ESG reporting and governance within Emergent. The ESG program is further guided by our internal Executive Steering Committee, and is under the responsibility of the Vice President, Assistant Treasurer reporting into the CFO. The ESG report is further consolidated in conjunction with the insights and perspectives from the Emergent Core ESG Team.

ESG Framework

Our ESG strategy is influenced by the Task Force on Climate-Related Financial Disclosures (TCFD) framework as well as the Sustainability Accounting Standards Board’s (SASB) standards focused on the healthcare, biotechnology, and pharmaceutical industries. The SASB standards provide guidelines on key sustainability issues that directly impact the operational performance and financial condition of our company.

ESG Priority Issues

Each year, we deliver, but alsowill conduct an assessment of these priorities and develop action items to advance progress in these areas. Our board will provide oversight and governance over the implementation and disclosures related to our ESG strategy. These priority issues are:

| ○ | | Diversity, Equity and Inclusion |

| ○ | | Environmental, Health and Employee Safety |

| ○ | | Governmental Relationships |

| ○ | | Manufacturing and Product Quality |

In furtherance of these objectives, we established a formal ESG review process in 2021 focused on identifying, measuring, and reporting on our ESG activities and progress and issued our inaugural ESG report in 2021 and our latest report in the fourth quarter of last year (the ESG Report). The ESG Report can be found at: https://www.emergentbiosolutions.com/wp-content/uploads/2022/11/2021-Emergent-ESG-Report.pdf. None of the information on or that can be accessed through our website is incorporated by reference in this proxy statement.

We expect that the ESG Report will enhance our disclosure to stakeholders on this important topic. Longer-term, it is our intent to reassess our progress annually and ensure alignment with our corporate strategic planning process.

Diversity, Equity and Inclusion

Diversity, equity, and inclusion (DEI) is integral to how we serve the communities in which we live and work. Throughout several cities in North America, we have developed philanthropic programs to strengthen relationships with local nonprofits and encourage employees to give back to the community. In 2012, we established eGIVE — Give, Invest, Volunteer in the communities in which we operate. Through eGIVE, employee-led teams are activated to direct donations to nonprofits and to organize volunteer activities in regions such as Baltimore, Maryland; Montgomery County, Maryland; Washington, D.C.; Lansing, Michigan; Canton, Massachusetts; Hattiesburg, Mississippi; and Winnipeg, Manitoba, Canada. Our eGive program enables every employee to bring their skills, their passion and their energy to building healthier and safer communities. Each employee has the ability to recommend charities to partner with or support and is given eight (8) hours of paid time off to volunteer and participate in the program.

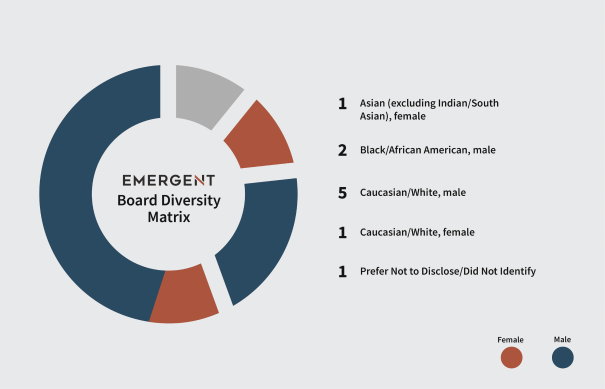

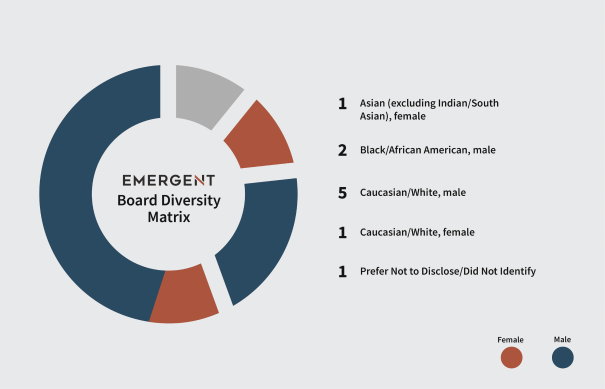

Diversity and Inclusion

Diversity and inclusion are an integral part of our culture for our Board members as well as our employees. Our corporate governance guidelines state that it is a goal of the Board to strive for diversity in the composition of the membership of the Board. We are also committed to attracting, developing, and retaining the best diverse employee talent. DiversityDEI fuels our business growth. Itgrowth, drives innovation in the products and services we develop, in the way we solve problems, and in the wayhow we serve the needs of an increasinglya global and diverse patient, customer, and partner base. We recognizeOur diverse workforce and inclusive environment create an organization rich with ideas, perspectives, and experiences. Our Chief Human Resources officer is responsible for developing and implementing our DEI programs and our executive management team is accountable for ensuring these programs are implemented.

Creating an Inclusive Culture

In 2021, we launched three inaugural employee resource groups to support and engage women, veterans and our Black/African American colleagues and those who identify as allies. Emerging Women, BRAVE and BOLD, respectively, have each led company-wide

|

| 4 EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy |

Sustainability and Corporate Social Responsibility

programming including educational campaigns, book clubs, and fireside chats on career development and leadership — in some cases, featuring members of our board of directors, our CEO, and other members of the value that diversity contributesexecutive team.

Our Talent Development Efforts

From recruiting, where we insist on diverse candidate slates for all roles, to our global organizationleadership development efforts, we aim to build and fill a robust, diverse internal talent pipeline. This strengthens our company and ensures all our colleagues have opportunities for career growth and development.

Supporting DEI in the competitive advantageCommunities Where We Live and Work

From STEM education in public schools to partnering with veterans groups for employment opportunities for transitioning veterans, our DEI efforts extend beyond the walls of Emergent into the communities where we can maintain by having a broad range of talents, perspectives,live and ideas with a commitmentwork.

Human Capital

Our people are our most valuable resource when it comes to continuously improvingachieving our business. We are also a proud supporter of our military veterans. We value the diversity that each employee brings, and while we look for people who share our Core Values, we thrive on difference. Employees come from different backgrounds and take on a wide variety of roles, but they are all working toward the same mission — to protect and enhance life.

Environmental Responsibility We aim to create a culture of respect, teamwork, inclusion and performance that allows each employee to thrive at work. Our human resources team is a strategic partner to the business, delivering programs and tools to attract, develop, and retain employees. Areas we focus on include the following:

| ○ | | Workforce Planning and Development |

| ○ | | Talent Acquisition and Onboarding |

| ○ | | Fully Hybrid, Global Workorce Model |

| ○ | | Employee Development through formal training, professional development, and learning on the job for all employees |

| ○ | | Leadership Development through two flagship, cohort-based, leadership development programs, Emergent Leader Solutions and Emergent Manager Solutions |

| ○ | | Annual Performance and Development Reviews |

| ○ | | Employee Health and Well-being |

| ○ | | Formal Mechanisms to Promote an ongoing, Employee Feedback Culture |

For additional information about our Human Capital management approach, we refer you to the section titled “Human Capital” in our Annual Report on Form 10-K for the fiscal year ended on December 31, 2022.

Community Involvement

Nearly a decade ago, Emergent launched its corporate social responsibility program Emergent GIVES to guide the company’s charitable efforts and expand its mission beyond what its products can provide. Since 2013, we have donated more than $6 million to a variety of charitable organizations in our communities, and employees have volunteered more than 45,000 hours with local nonprofits.

Through this commitment, Emergent has integrated itself into the communities where its sites are located. We continuallysupport our employees’ philanthropic activities by providing a company match for their charitable donations and paid time off for volunteerism, with one full day for full-time employees and a half day for part-time employees each year. Our philanthropic mission is aligned with our corporate goals, focused on advancing public health, protecting those who protect us, and educating tomorrow’s scientific leaders.

Corporate Social Responsibility

In 2022, Emergent GIVES introduced two new areas of focus, aligned with Emergent’s corporate strategy – Advancing Biosecurity and Biosafety, and Engaging Global Communities for Preparedness. We made two $100,000 donations in our inaugural year, funding work at Last Mile Health and Johns Hopkins University that directly support each of our corporate focus areas.

Combating the Opioid Epidemic

In partnership with Direct Relief, a third-party non-profit, Emergent donates product, including NARCAN Nasal Spray. In 2022, we donated more than 13,000 units (26,000 doses) of NARCAN Nasal Spray to safeguardDirect Relief for distribution to K-12 schools, Title IV-eligible, degree-granting colleges and universities, public libraries, YMCAs, and 501(c)(3) nonprofits.

For additional information about our charitable work, visit emergentbiosolutions.com/impact.

|

| EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy 5 |

Sustainability and Corporate Social Responsibility

Educating Tomorrow’s Scientific Leaders

Emergent Scholars

Emergent Scholars was designed for children of Emergent employees in partnership with Fuad El-Hibri, former Executive Chairman of the Board, to encourage the pursuit of higher education by providing scholarships to help fulltime undergraduate students study at an accredited two-year or four-year college or university, or a vocational technical school. Emergent awarded more than $80,000 in scholarships in the five years since the program began. In 2022, we awarded five $3,500 scholarships.

Volunteerism — Return to Service Week

In December 2021, Emergent began transitioning back to in-person volunteering activities with Return to Service Week. In five days, 127 employees across the globe volunteered 348 hours. Employees volunteered at local organizations such as The Baltimore Station, The Greater Lansing Food Bank, Siloam Mission, MANNA (Metropolitan Area Neighborhood Nutrition Alliance), Coastkeepers, Interfaith Social Services, Harvest Manitoba, and Heitere Fahne. Our Regional Corporate Social Responsibility (CSR) Teams finished the year strong with in-person as well as virtual events and continued to engage employees through volunteerism.

Environment, Health, and Safety Policy

The mission of Emergent BioSolutions is to protect and enhance life. This mission is not only about the patients and customers we serve, but extends to the lives of our employees, contractors and visitors, as well as the environment and health of the communities in which we live and work. Employee-led teamsoperate. We value a culture of breakthrough thinking, delivering on our commitments and employee engagement. Emergent employs an environment, health, and safety management system focused on identifying and mitigating risk. We address workplace conditions that have the potential for injury or illness through elimination, substitution, technical, organizational and personal measures. Environmental impacts are similarly addressed through opportunities to improve the sustainability of our operations and innovate our environmental stewardship strategy. Risk mitigation also includes fulfillment of our regulatory compliance obligations. Finally, we challenge ourselves to continually improve, by setting goals, monitoring performance, and evolving systematically to achieve excellence.

Sustainability and Environmental Management

We recognize that our operations have an impact on our local and global communities from the waste we generate, the energy we source, and the water we discharge. Environmental sustainability is a central consideration when improving and innovating our operational infrastructure across our enterprise and we must do our part to reverse the impacts of climate change which threaten environmental and human health. We evaluate ESG risks and opportunities related to climate change through the framework that the TCFD recommends: (i) governance, (ii) strategy, and (iii) risk management. As we further develop our environmental sustainability strategies, we intend to collect data on our Scope 1 and Scope 2 greenhouse gas emissions associated with our material operations. Doing so will enable Emergent to establish an energy baseline and prioritize future footprint reductions. This will also allow us to make informed decisions on setting targets and creating an accompanying strategy and road map for meeting our goals. In congruence, Emergent will determine the relevance of disclosure related to the quantifiable financial impact to our company under various global warming scenarios in line with TCFD recommendations.

Strategic Pillars

We have developed an environmental strategy based on our company mission to protect and enhance life, through improvement and innovation. Our “Improve” pillar is focused on making changes that matter, including reducing consumption of resources, optimizing operational efficiency and ensuring waste minimization. Our “Innovate” pillar is our opportunity for breakthrough thinking in the areas of renewable energy, resource alternatives and pollution prevention. As we gain greater insight into our environmental footprint, we will integrate these strategies into our processes and culture and develop scalable systems. To lead us on this path, we hired a director of environment and sustainability in the first quarter of 2022. Engaging all our employees is essential to our environmental efforts. On Earth Day, Emergent employees were challenged to move — walk, run or cycle, the Earth’s equator. The company matched $1 for every mile walked, which resulted in nearly 17,000 fruit trees being planted across India through One Tree Planted.

Occupational Health and Safety

As we work hard to deliver for our customers and patients, we do so with every employee’s health and safety in mind. Each employee is provided the tools, training, and information they need to work in a manner that protects their health and safety, as well as that of others. Core elements of our EHS programs include risk identification and mitigation, training, communications and employee engagement, and incident reporting and investigations. These programs drive local green initiatives. For example,our continually improving safety performance.

|

| 6 EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy |

Sustainability and Corporate Social Responsibility

Partnering with Small and Diverse Companies

We have made a commitment to actively pursue opportunities to work with small businesses that are minority-owned, women-owned, veteran-owned, disabled-owned, LGBTQ-owned, and small businesses that are located in historically underutilized business zones. Our supplier diversity program formalizes this commitment and has made it a priority throughout our organization as an important component of our broader DEI strategy. Since launching the program in 2020, we have multiple recycling programspartnered with 281 diverse suppliers to divert single-use garments worn by employees who work in manufacturing into useable products, such as furniture. We also have recycling programs where deposits collected from donated aluminum cans gosupport a variety of business areas.

Transparency

As we continue to local charties such aspublish our ESG report each year, we will further enhance our efforts, challenge ourselves to be even better, and report the Ronald McDonald House. Our Adopt-a-Highway program encourages employees to volunteer to keep a section of a highway free from litter. Our volunteer teams work hard at each of our highway and other park clean-up events, enjoying a day of fresh air while making an appreciated and worthwhile contribution to our surroundings.

Table of Contents

CORPORATE GOVERNANCE

General

results.

|

| EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy 7 |

Composition of the Board of Directors

Our by-laws provide that the number of directors shall be fixed from time to time by the Board. The Board has established the number of directors at ten.10. The Board is divided into three classes, with one class being elected each year and members of each class serving for staggered three-year terms. Sujata Dayal, Zsolt Harsanyi, Ph.D., General George A. Joulwan Seamus Mulligan and Louis W. Sullivan, M.D. are Class II directors with terms expiring at thisthe 2023 annual meeting. Dr. Sue Bailey,Ms. Dayal and Drs. Harsanyi and Sullivan are standing for reelection as Class II directors, while General Joulwan is not standing for reelection. Jerome Hauer, Ph.D., Robert Kramer and Robert G. Kramer,Marvin White are Class III directors with terms expiring at the 20212024 annual meeting. Fuad El-Hibri,Keith Katkin, Ronald B. Richard and Kathryn C. Zoon, Ph.D. are Class I directors with terms expiring at the 20222025 annual meetingmeeting. For more information regarding the members of our Board, please see "Directors“Directors and Nominees"Nominees” beginning on page 19.18.

General

Our Board believes that good corporate governance is important to ensure that the company is managed for the long-termlong- term benefit of our stockholders. This section describes key corporate governance guidelines and practices that our Board has adopted. Complete copies of our corporate governance guidelines and code of conduct and business ethics are available on our website at www.emergentbiosolutions.com under "Investors —“Investors – Governance."” Alternatively, you can request a copy of any of these documents by writing to Emergent BioSolutions Inc., Attn: Investor Relations, 400 Professional Drive, Suite 400, Gaithersburg, Maryland 20879.

Corporate Governance Guidelines

We are strongly committed to the highest standards of ethical conduct and corporate governance. These standards are consistent with our corporate culture. We understand that adhering to sound principles of corporate governance is critical to earning and maintaining the trust of our customers, employees and shareholdersshareholders. Accordingly, our Board has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of the company and our stockholders. These guidelines, which provide a framework for the conduct of the Board'sBoard’s business, include the following:

•The Board's principal responsibility is to oversee the management of the company;

•A majority of the members of the Board shall be independent directors;

•The independent directors shall meet regularly in executive session;

•Directors shall have full and free access to management and, as necessary and appropriate, independent advisors;

•New directors shall participate in an orientation program and all directors are expected to participate in continuing director education on an ongoing basis; and

•At least annually, the Board and its committees will conduct a self-evaluation to determine whether they are functioning effectively.

| ○ | | The Board’s principal responsibility is to oversee the management of the company; |

| ○ | | A majority of the members of the Board shall be independent directors; |

| ○ | | The independent directors shall meet regularly in executive session; |

| ○ | | Directors shall have full and free access to management and, as necessary and appropriate, independent advisors; |

| ○ | | New directors shall participate in an orientation program and all directors are expected to participate in continuing director education on an ongoing basis; and |

| ○ | | At least annually, the Board and its committees will conduct a self-evaluation to determine whether they are functioning effectively. |

Board Independence

Under applicable NYSENew York Stock Exchange (“NYSE”) rules, a director will qualify as "independent"“independent” only if our Board affirmatively determines that such director has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. Our Board has established guidelines to assist it in determining whether a director has such a material relationship. Under these guidelines, a director is not considered to have a material relationship with us if our Board determines that

Table of Contents

such director is independent under Section 303A.02(b)303A.02 of the NYSE Listed Company Manual, even if such director:

•Is an executive officer of another company which is indebted to us, or to which we are indebted, unless the total amount of either company's indebtedness to the other is more than 1% of the total consolidated assets of the company with which such director serves as an executive officer; or

•Serves as an officer, director or trustee of a tax-exempt organization to which we make contributions, unless our discretionary charitable contributions to the organization are more than the greater of $1 million or 2% of that organization's consolidated gross revenues. Our matching of employee charitable contributions would not be included in the amount of our contributions for this purpose.

| ○ | | Is an executive officer of another company which is indebted to us, or to which we are indebted, unless the total amount of either company’s indebtedness to the other is more than 1% of the total consolidated assets of the company with which such director serves as an executive officer; or |

| ○ | | Serves as an officer, director or trustee of a tax-exempt organization to which we make contributions, unless our discretionary charitable contributions to the organization are more than the greater of $1 million or 2% of that organization’s consolidated gross revenues. Our matching of employee charitable contributions would not be included in the amount of our contributions for this purpose. |

In addition, ownership of a significant amount of our stock, by itself (as under NYSE listing standards), does not constitute a material relationship. For relationships not covered by the guidelines set forth above, the determination of whether a material relationship exists is made by the other members of our Board who are independent.

|

| 8 EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy |

Corporate Governance

Corporate Governance

Our Board has determined that Dr. Bailey, Dr. Harsanyi, Dr. Hauer, General Joulwan,all of our current directors except Mr. Richard, Dr. Sullivan and Dr. ZoonRobert Kramer meet the foregoing standards, that none of these directors has a material relationship with us and that each of these directors is "independent"“independent” as determined under Section 303A.02 of the NYSE Listed Company Manual.

Meetings and Attendance

In 2019,2022, our Board met 1113 times and the standing committees of the Board met 26 times.30 times in aggregate. During 2019,2022, no director attended fewer than 75% of the total number of meetings of the Board of Directors and the total number of meetings of the committees of which the director was a member during 2019.member.

Our corporate governance guidelines provide that directors are expected to attend the annual meeting of stockholders. All then current members of our Board at the time of the 20192022 annual meeting of stockholders attended the meeting.

The Board'sBoard’s Role in Risk Oversight

Our Board is actively engaged in the oversight of risks we face and consideration of the appropriate responses to those risks. The audit and finance committee of our Board periodically discusses risk management, including guidelines and policies to govern the process by which our exposure to risk is handled, with our senior management. The audit and finance committee also reviews and comments on a periodic risk assessment performed by management. After the audit and finance committee performs its review and comment function, it reports any significant findings to our Board. The Board is responsible for the oversight of our risk management programs and, in performing this function, receives periodic risk assessment and mitigation initiatives for information and approval as necessary.

The Board'sBoard’s other committees oversee risks associated with their respective areas of responsibility. For example, the compensation committee considers the risks associated with our compensation policies and practices for both executive compensation and compensation generally.

Board Committees

Our Board has established five standing committees — audit and finance, compensation, nominating and corporate governance, scientific review and strategic operations — each of which operates under a written charter that has been approved by our Board. Our Board has also established a special committee on manufacturing and quality oversight to assist the Board with its oversight responsibilities of manufacturing and quality operations. Current copies of each committee'scommittee’s charter are available on our website at www.emergentbiosolutions.com under "Investors“Investors — Governance."” Alternatively, you can

Table of Contents

request a copy of any of these documents by writing to Emergent BioSolutions Inc., Attn: Investor Relations, 400 Professional Drive, Suite 400, Gaithersburg, Maryland 20879.

Our Board has determined that all of the current members of each of the audit and finance, compensation and nominating and corporate governance committees are independent as defined under the applicable rules of the NYSE.

|

| EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy 9 |

Corporate Governance

Committee Memberships

Below is a listing of each of the members of the Board of Directors, their class, term of office and committees on which they sit.

| | | | |

Sujata Dayal | |  Committee ChairpersonII | |  Committee Member2023 | | | | | | ✓ | | | | | | ✓ |

| | | | | | | | |

Jerome Hauer, Ph.D. | | III | | 2024 | | | | ✓ | | | | ✓ | | ✓c | | |

| | | | | | | | |

General George Joulwan* | | II | | 2023 | | ✓ | | ✓ | | ✓ | | | | | | |

| | | | | | | | |

Keith Katkin | | I | | 2025 | | | | | | ✓ | | | | ✓ | | |

| | | | | | | | |

Robert Kramer | | III | | 2024 | | | | | | | | | | ✓ | | |

| | | | | | | | |

Ronald Richard | | I | | 2025 | | ✓ | | | | ✓c | | | | ✓ | | |

| | | | | | | | |

Louis Sullivan, M.D. | | II | | 2023 | | ✓ | | ✓c | | ✓ | | | | | | ✓ |

| | | | | | | | |

Marvin White | | III | | 2024 | | ✓c | | | | | | ✓ | | ✓ | | |

| | | | | | | | |

Kathryn Zoon, Ph.D. | | I | | 2025 | | | | ✓ | | ✓ | | ✓c | | ✓ | | ✓c |

✓cCommittee Chair✓ Committee Member

| * | Not standing for reelection. |

Committee Descriptions

Below is a brief description of each Board committee and the scope of its responsibilities.

Audit and Finance Committee

The audit and finance committee’s responsibilities include:

| ○ | | Appointing, evaluating, approving the compensation of and assessing the independence of our Independent Registered Public Accounting Firm; |

| ○ | | Overseeing the work of our Independent Registered Public Accounting Firm, including through the receipt and consideration of reports from our Independent Registered Public Accounting Firm; |

| ○ | | Reviewing and discussing with management and the Independent Registered Public Accounting Firm our annual and quarterly financial statements and related disclosures; |

| ○ | | Reviewing the type and presentation of information to be disclosed in the company’s earnings press releases, as well as financial information and earnings guidance provided to analysts, rating agencies and others; |

| ○ | | Monitoring our internal control over financial reporting and disclosure controls and procedures; |

| ○ | | Providing assistance to the Board of Directors in the oversight of our risk management function and ethics and compliance program, including our Code of Conduct and Business Ethics; |

| ○ | | Providing assistance to the Board of Directors in the oversight of our internal audit function; |

| ○ | | Overseeing and monitoring the company’s cyber and information security risks and reviewing periodic updates from company management on the company’s policies, processes and significant developments related to the identification, mitigation and remediation of cybersecurity risks; |

| ○ | | Assisting the Board of Directors in overseeing our compliance with legal and regulatory requirements and internal policies and procedures; |

| ○ | | Periodically discussing our risk management policies, and reviewing and commenting on risk assessment by management; |

| ○ | | Assisting the Board of Directors in its oversight of financial planning, capital structures, the issuance of securities, use of swaps and stock buybacks; |

|

| 10 EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy |

Audit Committee

Corporate Governance

The audit committee's responsibilities include:

•Appointing, evaluating, approving the compensation of and assessing the independence of our Independent Registered Public Accounting Firm;

•Overseeing the work of our Independent Registered Public Accounting Firm, including through the receipt and consideration of reports from our Independent Registered Public Accounting Firm;

•Reviewing and discussing with management and the Independent Registered Public Accounting Firm our annual and quarterly financial statements and related disclosures;

•Reviewing the type and presentation of information to be disclosed in the company's earnings press releases, as well as financial information and earnings guidance provided to analysts, rating agencies and others;

•Monitoring our internal control over financial reporting and disclosure controls and procedures;

•Assisting the Board of Directors in overseeing our risk management function and ethics and compliance program, including our Code of Conduct and Business Ethics;

•Assisting the Board of Directors in overseeing our internal audit function;

•Assisting the Board of Directors in overseeing our compliance with legal and regulatory requirements and internal policies and procedures;

| ○ | | Reviewing, evaluating and approving the company’s investment policies and the company’s Foreign Exchange Policies; |

| ○ | | Meeting independently with our internal auditing staff, ethics and compliance lead, Independent Registered Public Accounting Firm and management; |

| ○ | | Reviewing and approving or ratifying any related person transactions; |

| ○ | | Evaluating, in coordination with the compensation committee, the company’s senior financial and ethics and compliance management, including the chief financial officer, chief ethics and compliance officer and head of internal audit; and |

| ○ | | Preparing the audit and finance committee report required by SEC rules, which is included on page 31 of this proxy statement. |

Table of Contents

•Periodically discussing our risk management policies, and reviewing and commenting on an initial risk assessment by management;

•Establishing policies regarding hiring employees from our Independent Registered Public Accounting Firm and procedures for the receipt and retention of accounting-related complaints and concerns;

•Meeting independently with our internal auditing staff, ethics and compliance lead, Independent Registered Public Accounting Firm and management;

•Reviewing and approving or ratifying any related person transactions;

•Evaluating, in coordination with the compensation committee, the company's senior financial and ethics and compliance management, including the chief financial officer, chief ethics and compliance officer and head of internal audit; and

•Preparing the audit committee report required by SEC rules, which is included on page 28 of this proxy statement.

The members of our audit and finance committee are Dr. Harsanyi, General Joulwan, Mr. Richard, Dr. Sullivan and Dr. Sullivan. Dr. Harsanyi isMr. White. Mr. White was appointed the chairpersonchair of this committee.committee effective April 1, 2022. Our Board has determined that each of the current members of the committee is "independent"“independent” in accordance with NYSE listing standards, meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934 (the "Exchange Act"“Exchange Act”), and is financially literate. Dr. Harsanyi hasand Mr. White have each been designated as the "auditan “audit and finance committee financial expert."” Our audit and finance committee met eightseven times during 2019.2022.

Compensation Committee

The compensation committee'scommittee’s responsibilities include:

•Annually reviewing and approving corporate goals and objectives relevant to the compensation of our executive officers;

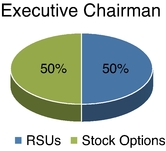

•Determining the compensation of our chief executive officer and executive chairman;

•Reviewing and approving the compensation of our other named executive officers;

•Overseeing the evaluation of our senior executives;

•Overseeing and administering our cash and equity incentive plans and employee stock purchase plan;

•Reviewing and discussing annually with management our "Compensation Discussion and Analysis," which is included beginning on page 34 of this proxy statement; and

•Preparing the compensation committee report required by SEC rules, which is included on page 54 of this proxy statement.

The processes and procedures followed by our compensation committee in considering and determining executive compensation are described below under "Executive Compensation — Executive Compensation Processes."

| ○ | | Annually reviewing and approving corporate goals and objectives relevant to the compensation of our executive officers; |

| ○ | | Determining the compensation of our chief executive officer; |

| ○ | | Reviewing and approving the compensation of our other named executive officers; |

| ○ | | Overseeing the evaluation of our senior executives; |

| ○ | | Overseeing and administering our cash and equity incentive plans and employee stock purchase plan; |

| ○ | | Reviewing and discussing annually with management our “Compensation Discussion and Analysis,” which is included beginning on page 36 of this proxy statement; |

| ○ | | Reviewing the results of any advisory stockholder votes on executive compensation (“say-on-pay votes”) and considering whether to adjust and/or recommend adjustments to the Board with respect to company’s executive compensation policies and practices as a result of such votes; and |

| ○ | | Preparing the compensation committee report required by SEC rules, which is included on page 52 of this proxy statement. |

The members of our compensation committee are Dr. Bailey, Dr. Hauer, General Joulwan, Dr. Sullivan and Dr. Sullivan.Zoon. Dr. Sullivan is the chairpersonchair of this committee. Our Board has determined that each of the members of the committee is "independent"“independent” in accordance with NYSE listing standards. Our compensation committee met seven times during 2019.

2022.

Table of Contents

Nominating and Corporate Governance Committee

The nominating and corporate governance committee'scommittee’s responsibilities include:

•Identifying individuals qualified to become members of the Board of Directors;

•Recommending to the Board of Directors the persons to be nominated for election as directors and appointed to each of the Board's committees;

•Reviewing and making recommendations to our Board of Directors with respect to director compensation;

•Reviewing and making recommendations to the Board of Directors with respect to management succession planning;

•Developing and recommending to the Board of Directors our corporate governance guidelines;

•Overseeing director education activities; and

•Overseeing an annual evaluation of the Board of Directors.

| ○ | | Identifying individuals qualified to become members of the Board of Directors; |

| ○ | | Recommending to the Board of Directors the persons to be nominated for election as directors and appointed to each of the Board’s committees; |

| ○ | | Reviewing and making recommendations to our Board of Directors with respect to director compensation; |

| ○ | | Reviewing and making recommendations to the Board of Directors with respect to management succession planning; |

| ○ | | Developing and recommending to the Board of Directors our corporate governance guidelines; |

| ○ | | Overseeing director education activities; |

| ○ | | Overseeing an annual evaluation of the Board of Directors; and |

| ○ | | Overseeing the company’s ESG activities. |

The processes and procedures followed by our nominating and corporate governance committee in identifying and evaluating director candidates and in making recommendations regarding director compensation are described below under the headings "Director“Director Nomination Process"Process” and "Director“Director Compensation,"” respectively.

The members of our nominating and corporate governance committee are Dr. Bailey,Ms. Dayal, General Joulwan, Mr. Katkin, Mr. Richard, Dr. Sullivan and Dr. Zoon. Mr. Richard is the chairpersonchair of this committee and also serves as our lead independent director.committee. Our Board has determined that each of the members of the committee is "independent"“independent” in accordance with NYSE listing standards. Our nominating and corporate governance committee met fiveseven times during 2019.2022.

|

| EMERGENT BIOSOLUTIONS INC. | 2023 Notice and Proxy 11 |

Corporate Governance

Scientific Review Committee

The scientific review committee'scommittee’s responsibilities include:

•Providing scientific advice and guidance to the Board of Directors regarding decisions related to existing products and technology platforms;

•Reviewing and advising the Board of Directors regarding the priorities with respect to our research and development portfolio to ensure alignment with corporate strategy; and

•Providing advice and guidance to the Board of Directors with respect to proposed acquisitions, in-licensing, collaborations and alliances.

| ○ | | Providing scientific advice and guidance to the Board of Directors regarding decisions related to existing products and technology platforms; |

| ○ | | Reviewing and advising the Board of Directors regarding the priorities with respect to our research and development portfolio to ensure alignment with corporate strategy; and |

| ○ | | Providing advice and guidance to the Board of Directors with respect to material proposed acquisitions, in-licensing, collaborations and alliances. |

The members of our scientific review committee are Dr. Bailey, Dr. Harsanyi, Dr. Hauer, Mr. MulliganWhite and Dr. Zoon. Dr. HauerZoon is the chairpersonchair of this committee. Our scientific review committee met threefour times during 2019.2022.

Strategic Operations Committee

The strategic operations committee'scommittee’s responsibilities include evaluating and making recommendations to the Board with respect to:

•Our mission, core strategy, strategic plan objectives/success criteria, and the strategic processes;

•Material acquisition and disposition opportunities;

•Material litigation and disputes;

•Our financial plans and programs and capital structure;

Table of Contents

•Our corporate investment policies; and

•Our corporate social responsibility activities.

The strategic operations committee is also responsible for reviewing, evaluating and approving:

•Our foreign exchange policy;

•Our decisions to enter into swaps; and

•Our corporate treasury policies, including our interest rate risk management and hedging policies.

| ○ | | Our mission, core strategy, strategic plan objectives/success criteria, and the strategic processes; |

| ○ | | Material acquisition and disposition opportunities; |

| ○ | | Material litigation and disputes; and |

| ○ | | Our activities on corporate reputation. |

The members of the strategic operations committee are Mr. El-Hibri, Dr. Harsanyi, Dr. Hauer, Mr. Katkin, Mr. Kramer, Mr. Mulligan,Richard, Mr. RichardWhite and Dr. Zoon. Mr. El-HibriDr. Hauer is the chairpersonchair of this committee. Our strategic operations committee met threefive times during 2019.2022.

Special Committee on Manufacturing & Quality Oversight

The special committee on manufacturing and quality oversight assists the Board with its oversight responsibilities regarding:

| ○ | | The company’s manufacturing organization and operations; |

| ○ | | The company’s quality organization and operations, including quality systems; |

| ○ | | The company’s compliance with current Good Manufacturing Practices and medical device Quality System Regulations; and |

| ○ | | Other legal and regulatory requirements related to the quality of the drugs and medical devices manufactured and produced by the company. |